- Bill to increase VAT in Nigeria passes second reading in Senate

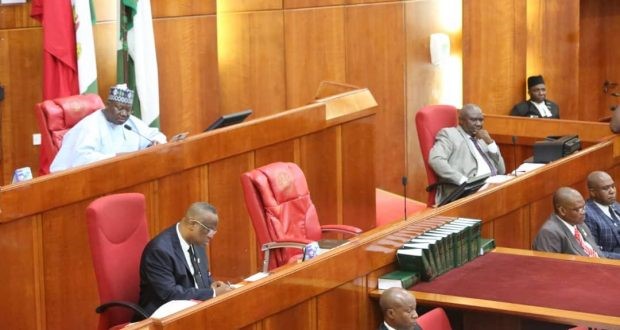

An Executive bill forwarded to the National Assembly seeking to make changes in the Nigerian tax and fiscal law scaled second reading at the upper chamber on Wednesday.

Senators however protested the non-inclusion of details of the bill, which seeks among others, raising the current Value Added Tax from five per cent to 7.5 per cent.

The lawmakers said the absence of the bill details would not enable them to make informed contributions.

The President of the Senate, Ahmad Lawan, however insisted that the bill be discussed without the details made available to senators.

Senators Yaroe Binus (Adamawa South) and Betty Apiafi (Rivers West) separately raised points of order, drawing the attention of the President of the Senate to the issue.

Lawan ruled both of them out of order and maintained that the details of the bill would only be made available at the committee level.

Lawan said, “To handle that, we have already asked that our secretariat distributes all the Acts that we want to amend and I want to urge the committee to work very assiduously.

“This should not be compromised at all. Our colleagues who raised the issue did so because they wanted to contribute.

“I think what we have done is still within our tradition and our convention of debating the general principles.

“The issue of revenue in Nigeria today is the major issue affecting our economy.

“The economy of this country like most developing economies depends on public expenditure and until we are able to get it, collate them efficiently and effectively we will not be able to fund public expenditure well.

“This bill will help in generating and collecting this kind of revenue.”

Leading the debate on the bill, the Senate Leader, Yahaya Abdullahi, said the bill sought to promote fiscal equity by mitigating instances of regressive taxation; reforming domestic laws to align with global best practices; and introducing tax incentives for investments in infrastructure and capital markets.